This post is about American Depositary Receipts (ADRs). If you’ve ever wondered about expanding your investment portfolio beyond the United States, ADRs offer an easy way to invest in international markets without the complexities of direct foreign investment. But what exactly are ADRs? How do they work? And what potential do they hold for investors? By the end of the post, we hope you will learn about ADRs, providing you with a clear understanding of what ADRs are, their benefits, and their risks.

Table of Contents

What is an American Depositary Receipt?

Does the name American Depositary Receipt sound too technical? like the immense number of terms Wall Street and finance people use? If yes, then let us explain what it is in simple, easy-to-understand sentences.

American Depositary Receipts are foreign stocks sold in the U.S. market. They are sold on both Nasdaq and the NYSE. You can purchase them through your stock broker, just like regular stock.

Now that a simple explanation is done, let’s see the technical explanation of what an American Depositary Receipt is.

An American Depositary Receipt (ADR) is a negotiable security issued by a U.S. depository bank, representing ownership in securities of a foreign company. Essentially, it’s a mechanism for U.S. investors to invest in foreign companies without directly owning the underlying foreign shares.

American Depositary Receipt allow you to invest in foreign security(shares) in US dollars while also allowing non U.S companies access to the U.S capital market.

Who Created the First American Depositary Receipt?

The first American Depositary Receipts (ADRs) were created by J.P. Morgan in 1927. They were issued on behalf of the British retailer Selfridges, allowing American investors to indirectly own shares in the company without needing to directly trade on the London Stock Exchange. This innovative financial instrument paved the way for greater international investment opportunities and became widely adopted in subsequent decades.

Both J.P Morgan and Selfridges are operating till today.

In the next section we will see how ADRs are created.

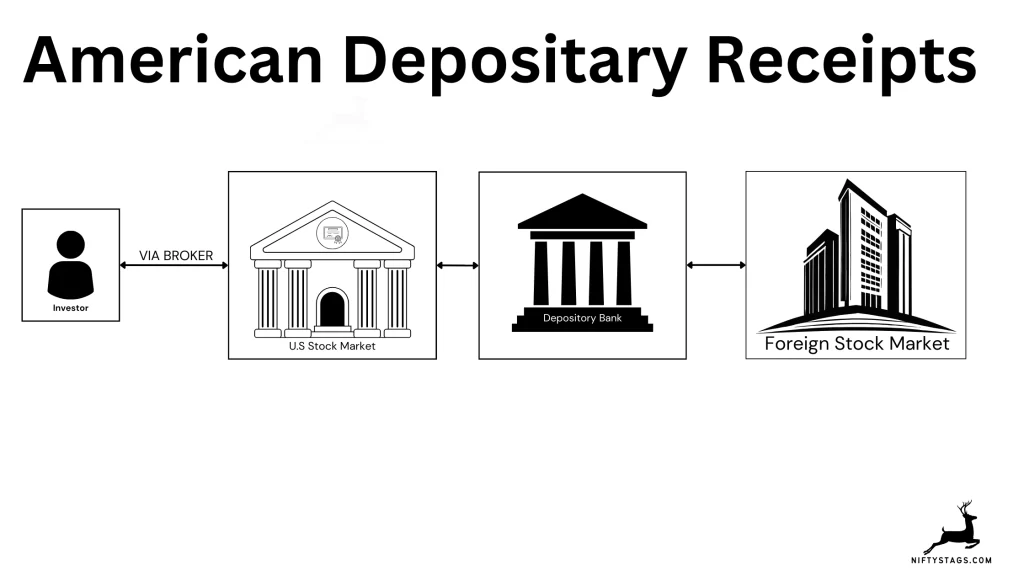

How are American Depositary Receipts Created?

- A foreign company seeking to access U.S. capital markets will enter into an agreement with a U.S. depository bank. ADR can also created without the cooperation of the company.

- The foreign company deposits its shares with the depository bank.

- The depository bank then issues ADRs, each representing a specific number of the foreign company’s shares.

- These ADRs are traded on U.S. stock exchanges, allowing U.S. investors to buy and sell them just like domestic stocks.

Types and Levels of American Depositary Receipts

American Depositary Receipts are characterized into types and levels.

There are two types of ADR and three levels of ADR. A detailed explanation of the types and levels are given below.

Types of American Depositary Receipts:

American depositary receipts are divided into two types. Sponsored and Unsponsored.

Sponsored ADR:

- Sponsored ADRs are issued with the cooperation of the foreign company whose shares underlie the ADR.

- The foreign company enters into an agreement with a depositary bank to issue ADRs representing its shares.

- Sponsored ADR programs typically have direct involvement and support from the foreign company, including financial reporting requirements and investor relations activities.

- Dividends are paid to ADR holders in U.S. dollars, making them more convenient for U.S. investors.

Unsponsored ADR:

- Unsponsored ADRs are issued without the direct involvement or cooperation of the foreign company.

- They are created by a depositary bank without the authorization or endorsement of the foreign company.

- Because they lack the support of the foreign company, unsponsored ADRs may have limited liquidity.

- Unsponsored ADRs do not need to comply with SEC requirements as it is created without the direct involvement of the company.

- Unsponsored ADRs are often created by depositary banks in response to investor demand for access to specific foreign stocks that do not have sponsored ADR programs.

- Unsponsored ADRs only trade over the counter.

In summary, sponsored ADRs have the backing and cooperation of the foreign company, while unsponsored ADRs are created independently by depositary banks. Sponsored ADRs typically offer more benefits and transparency to investors compared to unsponsored ADRs.

Levels of American Depositary Receipts

ADRs are classified into three levels. Level 1, Level 2, and Level 3. The levels represent how much the company has accessed the U.S markets.

Level 1 ADRs:

- Level 1 ADRs are the most basic type of ADR program.

- They are traded on U.S. over-the-counter (OTC) markets and do not require registration with the U.S. Securities and Exchange Commission (SEC).

- Level 1 ADRs have minimal reporting requirements, which means the foreign company is not required to provide financial disclosures or adhere to stringent U.S. accounting standards.

- These ADRs are typically used by foreign companies seeking to increase their visibility among U.S. investors without incurring the costs and regulatory burdens associated with higher levels of ADR programs.

- Level 1 ADRs may offer limited liquidity and transparency compared to higher levels.

Level 2 ADRs:

- Level 2 ADRs are listed on a U.S. stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ.

- Foreign companies issuing Level 2 ADRs are required to register with the SEC and comply with its reporting requirements, including providing audited financial statements.

- These ADRs provide greater visibility and accessibility to U.S. investors compared to Level 1 ADRs.

- Level 2 ADRs typically have higher liquidity and may attract more institutional investors due to their listing on a major U.S. exchange.

Level 3 ADRs:

- Level 3 ADRs are the highest level of ADR program.

- They involve a more extensive registration process with the SEC, including the filing of a registration statement similar to that of a U.S. initial public offering (IPO).

- Foreign companies issuing Level 3 ADRs must adhere to stringent SEC reporting requirements, including providing detailed financial disclosures and adhering to U.S. Generally Accepted Accounting Principles (GAAP).

- These ADRs offer the greatest visibility, transparency, and access to U.S. capital markets.

- Level 3 ADRs are often pursued by large, well-established foreign companies seeking to raise capital in the U.S. or enhance their global profile.

| Type | Regulation Requirement | Capital Raising |

|---|---|---|

| Level 1 | Low. (Should only file Form F-6) | No |

| Level 2 | Medium. (File Form F-6 and F-20) | No |

| Level 3 | High. (File Form Form F-1, F-6, and Form 20-F) | Yes |

In summary, Level 1, Level 2, and Level 3 ADRs offer varying degrees of access to U.S. capital markets, with Level 3 ADRs being the most comprehensive and prestigious option, followed by Level 2 and Level 1 ADRs, respectively.

Example of American Depositary Receipts

To understand ADRs better, let us imagine a scenario where you are an investor who wants to invest in video game stocks. From your research, you find that beyond the U.S., companies such as Capcom Co Ltd, Nintendo Co., Ltd, Sony Group Corp are some of the major players in the video game space. As a domestic investor, you do not have a presence in the Japanese stock market to purchase the stock.

This is where American Depositary Receipts are helpful. Rather than signing up with a foreign broker and getting approved by them, then having to buy the share, you can directly buy it from your U.S. stock broker and pay it in dollars rather than the foreign company’s domestic currency.

Below are some of the major global companies that have ADRs in the U.S. market.

- Alibaba Group Holding Limited (BABA)

- Tencent Holdings Limited (TCEHY)

- Samsung Electronics Co., Ltd. (SSNLF)

- Toyota Motor Corporation (TM)

- Nestlé S.A. (NSRGY)

What Is the Difference Between ADR and GDR?

ADRs are traded in the United States and represent shares of a foreign company. They are denominated in US dollars and are subject to US regulations, while Global Depositary Receipts (GDR) are also shares of foreign companies; they are traded in multiple foreign markets around the globe, such as Asian markets, Eurozone markets, and American markets.

To explain it in simpler terms, ADR trade only U.S market while GDR trade in multiple markets.

What to Do Before Investing in American Depositary Receipts

- Like researching any other stock, research and know everything about company you are about to invest in.

- Research the political, economic, and social conditions in the company’s home country that can affect the stock price.

- Keep in mind disclosure requirements vary depending on the type and level of ADR.

- Ask your stock broker on what the fee are charged to them for investing in ADR.

Advantages of American Depositary Receipt

- Diversification: ADRs let you invest in companies from other countries, which helps spread out your investments and reduce risk.

- Convenience: You can buy ADRs through your regular US brokerage account, so you don’t need to open a special international account.

- Currency Flexibility: ADRs are priced in US dollars, so you don’t have to worry about exchange rates changing the value of your investment. Dividends are also pain in U.S dollars

- Transparency and Regulation: ADRs follow strict US laws and rules (Sponsored ADRs), which means you get more information and protection as an investor.

- Access to Global Brands: ADRs let you invest in well-known companies from other countries that you might recognize.

- Chance for Growth: Investing in ADRs gives you a chance to grow your money by investing in companies from growing economies and industries.

Risks of Investing in American Depositary Receipts

- Currency Risk: While, ADR payout in dollars, Fluctuations in exchange rates can affect the value of ADRs when converted back into USD.

- Political and Economic Risk: ADRs tied to companies in politically or economically unstable regions may be affected by political unrest, changes in government policies, or economic downturns.

- Lack of Information: Some ADRs, especially those at lower levels, may have limited financial information available, making it challenging for investors to assess their true value.

- Market Risk: ADR prices can be influenced by overall market conditions, including changes in interest rates, inflation, and investor sentiment.

- Liquidity Risk: ADRs with low trading volumes may have wider bid-ask spreads, making it harder to buy or sell them at favorable prices.

- Legal and Regulatory Risk: ADRs may be subject to different regulatory standards and accounting practices than domestic securities, which can affect investor protections and transparency. The regulatory requirements also vary depending on the level of ADR.

- Company-specific Risks: ADRs represent ownership in a specific foreign company, so they are exposed to company-specific risks such as management issues, competitive pressures, and industry challenges.

- Repatriation Restrictions: Some countries impose restrictions on the repatriation of profits or capital, which can affect the ability of ADR investors to receive dividends or sell their shares.

- Additional Fees: ADRs might be subject to additional fees from the issuer. Fees such as ADR Pass-Through Fees, fee for processing dividends and corporate actions.

- Termination of ADR: While it is rare, the issuer company can terminate ADR program if significant interest is not shown or for any number of reasons. This can cause your position to be liquidated or converted into original shares of the foreign company.

It’s essential for investors to thoroughly research and understand these risks before investing in ADRs and to diversify their portfolios to mitigate potential losses. Consulting with a financial advisor can also help assess individual risk tolerance and investment goals.

FAQ on American Depositary Receipts

What are the types of ADR?

Sponsored and Unsponsored.

What are the levels of ADR?

Depending on the access to U.S markets the levels of ADR are Level 1, Level 2m and Level 3.

Can you buy ADR in U.S dollars?

Yes, the main advantage of ADR is owning foreign shares by paying in U.S dollars rather than the foreign company’s domestic currency.

How are dividends paid on ADRs?

Dividends on ADRs are typically paid in U.S. dollars by the depositary bank, which collects dividends from the foreign company and distributes them to ADR holders.

What are the benefits of investing in ADRs?

ADRs provide U.S. investors with access to international markets, diversification opportunities, and the ability to invest in well-known foreign companies.

How many ADRs are traded in the U.S market?

Currently there are more than 2000 ADRs of companies traded in the U.S market from over 70 countries.

Pingback: Video Game Stocks List In US Market - Niftystags