If you are a newbie to the Indian markets, you would have often seen the term “GIFT Nifty” pop up in the financial news, usually before the market opens. We made a post just to explain to newcomers what its all about. The short explanation is that Gift Nifty is the Nifty 50 index derivative that is traded in GIFT City. It’s named by combining Gift City and the Nifty 50 derivative, and hence it’s called Gift Nifty.

Now that we are done with the short explanation of what GIFT Nifty is, if you are interested in the in-depth details behind it, do read on!

Table of Contents

What is Gift City and Its Relationship to the Gift Nifty Index?

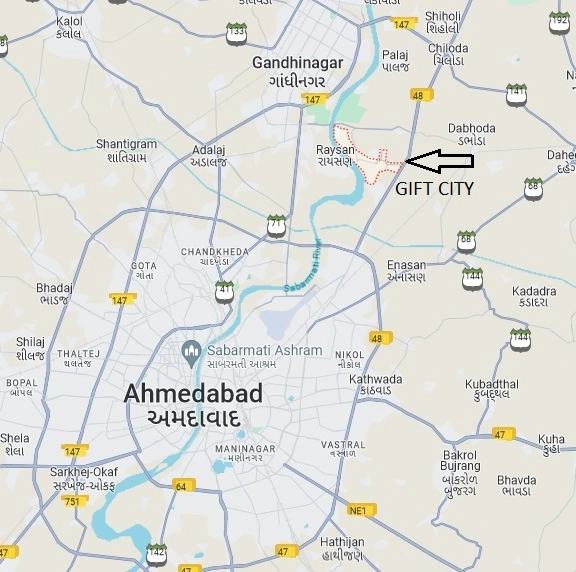

GIFT City (Gujarat International Finance Tec-City) was a plan envisioned in 2007 by Narendra Modi, who was the chief minister of Gujarat. The plan was to build an international finance center similar to those in Shanghai, Hong Kong, and Singapore.

In the present day, Gift City is starting to become a city of financial importance in the Indian economy. The city is a special economic zone, where companies that set up offices here can enjoy a 10-year tax exception. There is also no GST levied for services levied to and from GIFT city-registered units. And a whole lot of other government incentives are offered to attract more companies.

Like most major companies, NSE also opened a subsidiary office in GIFT City called NSE International Exchange IFSC Limited, also known as NSEIX.

NSEIX started offering a derivative product of Nifty 50 that could be traded on its exchange in GIFT City. And thus the GIFT Nifty index was born.

What is GIFT Nifty?

Like we mentioned earlier, the GIFT Nifty is the derivative index of the Nifty 50 index. The index was originally traded on the Singapore stock exchange under the ticker SGXNIFTY with the agreement of NSE.

If you notice, most major economies such as the US, UK, Japan, and China have their international index traded on their sovereign soil, which was not the case for India. India’s Nifty 50 international version of the derivative was traded on the Singapore stock exchange.

To protect India’s sovereign financial index, the Indian government took steps to bring the index to India. In 2018, NSE ended its licensing agreement with the Singapore Exchange to offer SGXNIFTY. After this, the Singapore exchange announced the launch of its own derivative version of Nifty 50. NSE claimed this move infringed on its intellectual property rights and took legal remedies to correct it. The dispute reached a legal conclusion, and both parties agreed to a joint venture in September 2020.

On July 3, 2023, the GIFT Nifty contract started trading after moving the entire liquidity from the Singapore exchange.

By shifting the trading to India from Singapore, India has made sure its financial instrument is being traded in India rather than a foreign one, thereby maintaining its financial sovereignty.

Now all the contracts have shifted from the Singapore exchange to the Indian exchange, which is operated out of Gift City by NSEIX, hence its name, GIFT Nifty. The index is also a joint venture between the NSE and the Singapore Stock Exchange. SGX Nifty is now GIFT Nifty

What is the Significance of Gift Nifty?

- For domestic traders and investors, Gift Nifty has been a pre-market indicator of how the Nifty 50 index will open.

- The index is also a good method of seeing how the Indian index might react to news that happened overnight when the domestic market was closed.

- Institutional investment firms can buy the derivative in dollars rather than rupees, thereby giving them ease of doing business.

- The daily average turnover of SGXNifty was $3.9 billion; now this turnover was generated abroad, but now the turnover will be generated in GIFT City.

- By being open for 21 hours a day, it is attracting the interest of investors from Asia, Europe, and America.

What is the Operating Time of Gift Nifty index?

Gift Nifty trades over two sessions. The first session starts at 6:30 a.m. to 3:40 p.m., and the second session starts from 4:35 p.m. to 2:45 a.m. the next day. This is done to allow foreign financial institutions to trade during their normal business hours. Thereby, the derivative can be traded for a total of 21 hours in a day.

| Session | Pre Market Timing | Operating Hours |

|---|---|---|

| Session 1 | 6:15 a.m. to 6.29 a.m. | 6:30 a.m. to 3:40 p.m. |

| Session 2 | 4:20 p.m. to 4:34 p.m. | 4:35 p.m. to 2:45 a.m.(next day) |

Who Can Trade the GIFT Nifty Index?

Any trading member, Indian or foreign, registered or non-registered, setting up its office through a subsidiary or branch model, can start trading in the GIFT Nifty products by taking a member ship of NSEIX.

Note: Domestic retail traders and investors, however, cannot trade in GIFT Nifty under the RBI’s Liberalized Remittance Scheme (LRS).

What are the Different Types of GIFT Nifty Contracts?

- GIFT Nifty 50 tracks Nifty 50 index.

- GIFT Nifty Bank tracks Nifty Bank index.

- GIFT Nifty Financial Services tracks Nifty Financial Service index(finnifty).

- GIFT Nifty IT tracks Nifty IT.

FAQ on GIFT Nifty

Who is the regulator of GIFT Nifty index?

International Financial Services Centres Authority (IFSCA) is the regulatory authority of the index.

What happened to SGX Nifty after the formation of GIFT Nifty?

SGX Nifty was eventually delisted after GIFT Nifty started trading.

What is difference between Nifty 50 and GIFT Nifty?

GIFT Nifty is the name of the derivative contract of Nifty 50 traded in GIFT City, while Nifty 50 is the name of the index of the top 50 companies in the Indian stock market.

What is the highest daily turn over of Gift Nifty?

$22.2 Billion On January 23, 2024.

awesome