The Nifty IT stocks along with their weightages are listed below. This post is a analysis on the Nifty IT index and various information you should know before investing in the index.

Table of Contents

What is Nifty IT Index?

The Nifty IT Index also known as Nifty Information Technology Index is a Indian stock market index that captures the performance of the Information Technology sector. The Index consist of top 10 Indian IT companies by market capitalization. IT companies in India have played a very important role in the growth story of the Indian economy. The Nifty IT index is maintained by National Stock Exchange (NSE) of India.

The Nifty IT index provides a benchmark for investors to gauge the performance of the IT sector in India. It is also an indicator of the overall health of the Indian economy, as the IT sector is one of the major contributors to the country’s GDP.

According to a report by the National Association of Software and Services Companies (NASSCOM), the IT sector in India is expected to reach a revenue of USD 194 billion in 2025, with a compounded annual growth rate (CAGR) of 9.2% from 2020-2025.

Majority of the companies in Nifty IT index is also a part of Nifty 50 index.

Nifty IT Stock with Their Weightage:

The Nifty IT stocks are given in the table below. The highest weightage is given to Infosys Ltd. at 27.85% followed by Tata Consultancy Services at 22.84%. The complete table is given below.

| No. | Stock Name | Weightage |

|---|---|---|

| 1 | Infosys Ltd. | 27.85% |

| 2 | Tata Consultancy Services Ltd | 22.84% |

| 3 | HCL Technologies Ltd. | 11.08% |

| 4 | Tech Mahindra Ltd. | 9.79% |

| 5 | Wipro Ltd. | 7.73% |

| 6 | Persistent Systems Ltd. | 6.15% |

| 7 | Coforge | 5.81% |

| 8 | LTI Mindtree Ltd. | 4.67% |

| 9 | MphasiS Ltd. | 2.91% |

| 10 | L&T Technology Services Ltd. | 1.17% |

The top five companies in the index were Tata Consultancy Services, Infosys, Wipro, HCL Technologies, and Tech Mahindra. These companies account for more than 75% of the total weightage of the index.

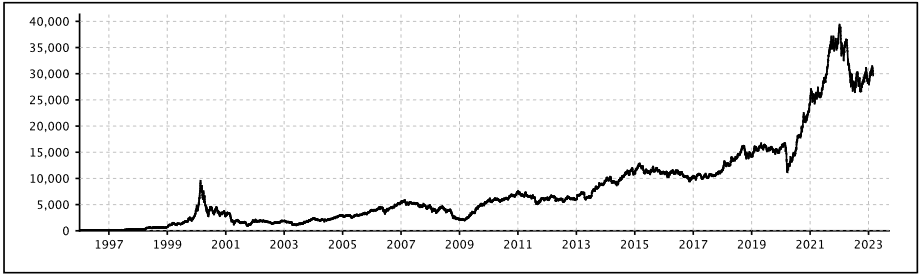

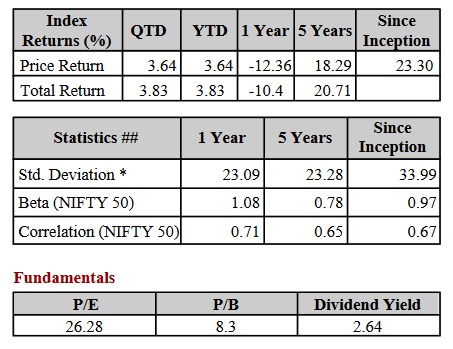

Nifty IT Index Historical Performance:

How to invest in the Nifty IT index:

To invest in the index you can buy all the Nifty IT stocks at their current weightage given above, or invest in Nifty IT Exchange Traded funds listed below.

Nifty IT Exchange Traded Funds (ETFS):

- Nippon India ETF Nifty IT

- ICICI Prudential Nifty IT ETF

- Kotak Nifty IT ETF

- SBI ETF Nifty IT

- IT Bees

Index Methodology:

The index is calculated using a free float market capitalization-weighted methodology. This means that the weight of each company in the index is proportional to its market capitalization, adjusted for the number of shares that are freely available for trading in the market. This methodology ensures that the larger and more influential companies have a greater impact on the performance of the index. Do check out our separate detailed post on what free float market capitalization is here.

Eligibility criteria for a stock to be added to the index:

- Companies should form part of Nifty 500 at the time of review. In case, the number of eligible stocks representing a particular sector within Nifty 500 falls below 10, then deficit number of stocks shall be selected from the universe of stocks ranked within top 800 based on both average daily turnover and average daily full market capitalization based on previous six months period data used for index rebalancing of Nifty 500.

- Companies should form a part of the IT sector.

- The company’s trading frequency should be at least 90% in the last six months.

- The company should have a listing history of 6 months.

- Final selection of 10 companies shall be done based on the free-float market capitalization. A preference shall be given to companies that are available for trading in NSE’s Futures & Options segment at the time of final selection.

- Weightage of each stock in the index is calculated based on its free-float market capitalization such that no single stock shall be more than 33% and weightage of top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing.

Index rebalancing:

The index is rebalanced on a semi-annual basis. The cut-off dates are January 31 and July 31 of each year. For semi-annual review, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of change.

Nifty financial Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Factors Affecting Nifty IT Companies:

- Global economic conditions: As the IT industry is largely driven by outsourcing to countries like India, any changes in the global economy can have an impact on the industry and hence affect the prices of Nifty IT stocks.

- Currency fluctuations: Since the IT industry in India generates a significant portion of its revenue in foreign currencies, any fluctuations in exchange rates can impact the profits of IT companies, which can in turn impact the performance of the Nifty IT companies.

- Government policies: The government policies related to taxation, regulations, and incentives for the IT industry can have a significant impact on the industry’s growth, which can impact the Nifty IT Index companies.

If you liked this post do check out our other similar post on other index such as Bank Nifty, Nifty Finance, Nifty Auto.