The Nifty Media Index is designed to reflect the behavior and performance of the Media and Entertainment sector, including printing and publishing. In this post, let’s see an overview of the Nifty Media Index.

Table of Contents

What is Nifty Media Index?

The Nifty Media Index is a sector-specific index that represents the performance of media companies listed on the National Stock Exchange of India (NSE). The Index was launched on July 19, 2011, with a base date of December 30, 2005, and a base value of 1000.

The index is calculated in real time using free float market capitalization method. Free float refers to the shares of a company that are available for trading in the open market. It excludes shares held by promoters, strategic investors, or locked-in shares.

Nifty Media Index Stocks List with Weightage

There are 10 Companies in the Nifty Media Index. The highest weightage is given to Zee Entertainment Enterprises Ltd at 21.27% followed by PVR INOX Ltd at 20.22%. The entire list is given below.

| No. | Company Name | Symbol | Weightage |

|---|---|---|---|

| 1 | Zee Entertainment Enterprises Ltd. | ZEEL | 21.27% |

| 2 | PVR INOX Ltd. | PVRINOX | 20.22% |

| 3 | TV18 Broadcast Ltd. | TV18BRDCST | 11.17% |

| 4 | Sun TV Network Ltd. | SUNTV | 10.79% |

| 5 | Saregama India Ltd | SAREGAMA | 8.28% |

| 6 | Dish TV India Ltd. | DISHTV | 7.78% |

| 7 | Network18 Media & Investments Ltd. | NETWORK18 | 7.36% |

| 8 | Nazara Technologies Ltd. | NAZARA | 6.35% |

| 9 | DB Corp Ltd | DBCORP | 4.02% |

| 10 | Hathway Cable & Datacom Ltd. | HATHWAY | 2.75% |

Nifty Media Index Historical Performance Chart

You can check the current price and chart of the index here

The Index has given a total return of 4.40% since inception.

Nifty Media Index VS Other Indices

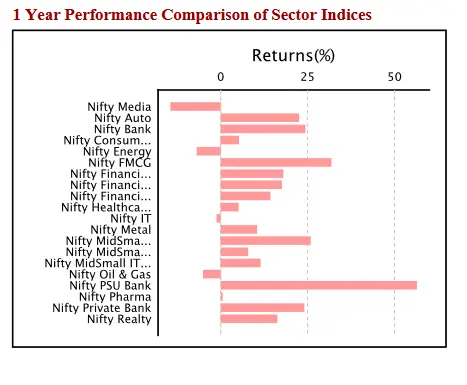

As you can see from the past year’s performance, Nifty Media has been the worst performer compared to other indices.

Eligibility Criteria for a Stock to be Added to the Index

- Companies should form part of the Nifty 500 index at the time of review. In case the number of eligible stocks representing a particular sector within the Nifty 500 falls below 10, then deficit number of stocks shall be selected from the universe of stocks ranked within the top 800 based on the both average daily turnover and average daily full market capitalization based on previous six-months period data used for index rebalancing of Nifty 500

- Companies should form a part of the media sector.

- The company’s trading frequency should be at least 90% in the last six months.

- The company should have a listing history of 6 months. A company that comes out with an IPO will be eligible for inclusion in the index if it fulfills the normal eligibility criteria for the index for a 3-month period instead of a 6-month period.

- Final selection of companies shall be done based on the free-float market capitalization of the companies.

- The weightage of each stock in the index is calculated based on its free-float market capitalization, such that no single stock shall be more than 33% and the weightage of top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing.

Index Rebalancing

The Index is rebalanced on a semi-annual basis. The cut-off date is January 31 and July 31 of each year.

For semi-annual review of indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to the market before the changes.

Index Governance

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee.

Nifty Media Index ETFs

Currently there are no ETF that tracks the Nifty Media Index.

Does Nifty Media Index have a derivative section?

No, The Nifty Media Index does not a derivative sections but certain individual stocks in the index have their own derivative sections.