The complete Nifty FMCG Index stock list, along with its weightages is given below. This post is to learn more about the index, how it compares to other indexes and a overall general features of the index.

Table of Contents

What is Nifty FMCG Index?

The Nifty FMCG Index is a stock market index designed to reflect the FMCG (Fast Moving Consumer Goods) sector of the Indian stock market. These companies produce everyday essential goods that have a high consumption rate like biscuits, beverages, foods, household products, toiletries, personal care products, etc. Typically, these products are low cost, frequently purchased, quickly consumed, and easily available to purchase. Products from the FMCG sectors play an essential role in majority of people lives.

The index is maintained by NSE. The index is calculated using free float market capitalization method. Free float market capitalization refers to the value of a company’s shares that are available for trading in the open market. These shares are those that are freely available for purchase by investors and are not held by controlling shareholders (promoters) or institutions.

Nifty FMCG Index Stocks List with Weightage:

The highest weightage in Nifty FMCG index given to ITC Ltd at 32.88% followed by Hindustan Unilever at 19.14%. Complete list is given below.

| No. | Company Name | Symbol | Weightage |

|---|---|---|---|

| 1 | ITC Ltd. | ITC | 32.88% |

| 2 | Hindustan Unilever Ltd. | HINDUNILVR | 19.14% |

| 3 | Nestle India Ltd. | NESTLEIND | 8.86% |

| 4 | Tata Consumer Products Ltd. | TATACONSUM | 6.53% |

| 5 | Varun Beverages Ltd. | VBL | 6.36% |

| 6 | Britannia Industries Ltd. | BRITANNIA | 5.49% |

| 7 | Godrej Consumer Products Ltd. | GODREJCP | 4.48% |

| 8 | Colgate Palmolive (India) Ltd. | COLPAL | 3.42% |

| 9 | United Spirits Ltd. | MCDOWELL-N | 3.12% |

| 10 | Dabur India Ltd. | DABUR | 2.9% |

| 11 | Marico Ltd. | MARICO | 2.44% |

| 12 | Procter & Gamble Hygiene & Health Care Ltd. | PGHH | 1.51% |

| 13 | Radico Khaitan Ltd | RADICO | 1.27% |

| 14 | United Breweries Ltd. | UBL | 1.22% |

| 15 | Balrampur Chini Mills Ltd | BALRAMCHIN | 0.39% |

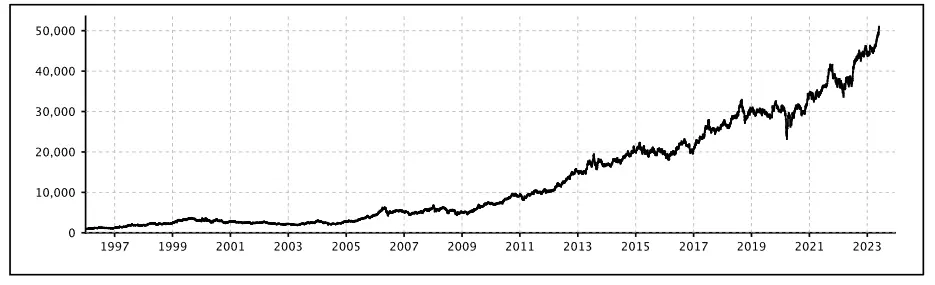

Nifty FMCG Chart:

For live price of Nifty FMCG Index check here

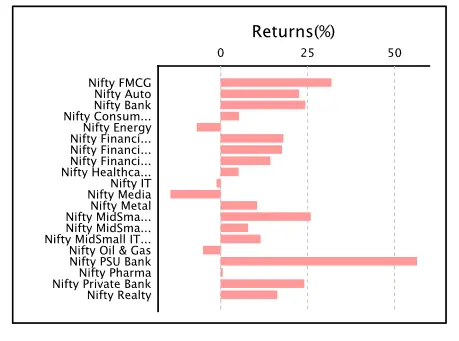

Nifty FMCG Performance Against Other Sectors:

When comparing to other sectors Nifty FMCG index has been the second best performer after Nifty PSU Bank in the recent months.

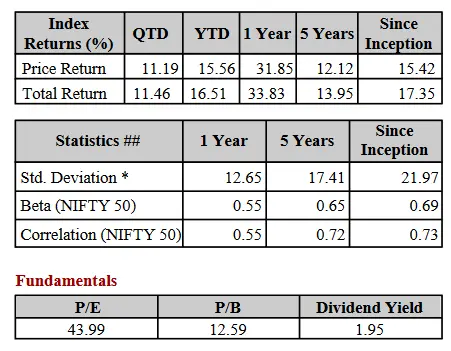

Nifty FMCG PE Ratio and Other Fundamentals:

The index has given a return of 17.35% return since its inception.

Nifty FMCG ETFS:

- ICICI Prudential Nifty FMCG ETF (ICICIFMCG)

- SBI Nifty Consumption ETF is also an ETF which tracks major part of the index but also includes parts of other sectors as well.

Nifty FMCG Index Funds:

- UTI Nifty FMCG Index Fund

- ICICI Prudential FMCG Fund

Nifty FMCG Index Selection Criteria:

A stock must satisfy the following conditions to be added to the Index

- Companies should form part of Nifty 500 at the time of review. In case, the number of eligible stocks representing a particular sector within Nifty 500 falls below 10, then deficit number of stocks shall be selected from the universe of stocks ranked within top 800 based on both average daily turnover and average daily full market capitalization based on previous six months period data used for index rebalancing of Nifty 500.

- Companies should form a part of the FMCG sector.

- The company’s trading frequency should be at least 90% in the last six months.

- The company should have a listing history of 6 months. A company which comes out with an IPO will be eligible for inclusion in the index, if it fulfills the normal eligibility criteria for the index for a 3 month period instead of a 6 month period.

- Final selection of 15 companies shall be done based on the free-float market capitalization of the companies.

- Weightage of each stock in the index is calculated based on its free-float market capitalization such that no single stock shall be more than 33% and weightage of top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing

How to Invest in Nifty FMCG Index:

Currently the best way to invest in FMCG index is to buy FMCG Index funds such as UTI Nifty FMCG Index Fund and ICICI Prudential FMCG Fund or FMCG ETF such as ICICI Prudential Nifty FMCG ETF (ICICIFMCG).

Index Re-Balancing:

The FMCG Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of change.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

FAQ on Nifty FMCG Index

How many Stocks are there in the Nifty FMCG Index?

15 stock constituents from the FMCG sector are present in Nifty FMCG Index.

Which Stock/Company Has the Highest Weightage in Nifty FMCG Index?

ITC Ltd has the highest weightage in the FMCG at 31.46%.

Does Nifty FMCG Have a derivative segment(Futures and Options)?

No, The Nifty FMCG index does not have a derivative segment, however certain Individual stocks have their own Futures and Options segment.

Bottomline:

The Nifty FMCG sector has been the second best performer among the various indices in the market after Nifty PSU Bank. The index is also used as a economic indicator. Consumer spending and consumption on essential and daily goods reflects the overall sentiment and health of the economy.

If you like this post do check out our similar post weightages and analysis on other index like Nifty Metal , Nifty IT and Nifty Pharma.